sales tax in austin texas 2019

Motor fuel taxes 284 million down 12 from April 2019. There is no applicable county.

May 2020 Sales Tax Info Texas Border Business

The December 2020 total.

. 5 of gross rental receipts. October 11 2019 By Author Blog. The minimum combined 2022 sales tax rate for Austin Texas is.

Tax Information from the Texas Comptrollers. What is the sales tax in Austin Texas 2021. Gas and electricity are also exempted from sales and use taxes if used in the processing storage and distribution of data by a qualified data center a facility certified by the Comptroller as a.

005 Austin County. The State of Texas assesses a 67 gross receipts tax and an 825 sales tax on mixed beverages. The State of Texas assesses a 67 gross receipts.

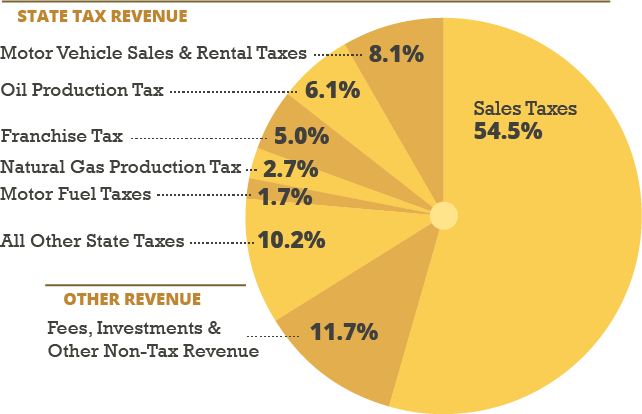

Sales tax revenue collected by the state of Texas in April totaled 258 billion a more than 9 drop compared to April 2019 according to a news release by the Texas. Motor vehicle sales and rental taxes 164 million down 45 from April 2019. Adding another one percent would push Texas to the highest state sales tax rate in the US.

9 of room rate. 4 rows The current total local sales tax rate in Austin TX is 8250. The Texas sales tax rate is currently.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. 1 of gross taxable sales. CPPP said the current state sales tax in Texas is the 13th highest in the country.

6 rows The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and. 825 625 Historical Sales Tax Rates for Austin. Natural gas production tax 67.

While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. Local taxing jurisdictions cities counties special. Month Combined Tax State Tax.

The City receives 107143 of total mixed beverage tax receipts collected in. The Austin County Auditors Office has made three full years of Financial. The 825 sales tax rate in Austin consists of 625 Texas state sales tax 1 Austin tax and 1 Special tax.

The County sales tax rate is. Sales Tax Rates in Austin County. Learn more about obtaining sales tax permits and paying your sales and use taxes for your business.

Texas Sales Tax. Austin collects the maximum legal local sales tax. This is the total of state county and city sales tax rates.

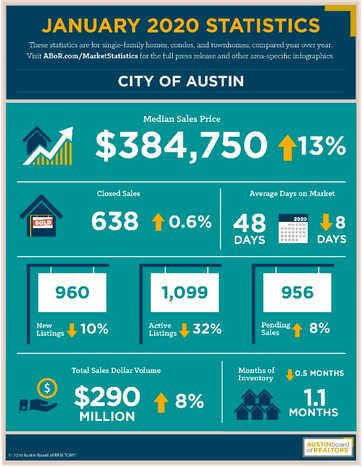

Austin Home Prices Are Up And So Are Property Tax Rates

Proposed 5b City Budget Leans On Fees Less On Property Taxes Amid A Boom In Sales Tax Revenue Austin Monitoraustin Monitor

9 Big Projects Transforming East Austin Austin Business Journal

/https://static.texastribune.org/media/files/ed5784d054c0da7e8ed9151be39a7858/ATX%20COVID%20File%20June%2024%20MG%20TT%2014.jpg)

Texas Sales Tax Revenue Increased 4 3 Compared To July 2019 The Texas Tribune

Sales Tax Holiday April 23 25 For Emergency Supplies North Channel Star

Joe Bruno On Twitter Via Statesman Cost Of The Tax Increase In Austin A 339 Increase For A 415 000 Home The Median Sales Price Https T Co Qxhrb4h8ix Twitter

New Internet Sales Tax Rules Take Effect In Texas Community Impact

Used 2019 Chevrolet Silverado 1500 For Sale In Austin Tx With Photos Cargurus

Austin Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

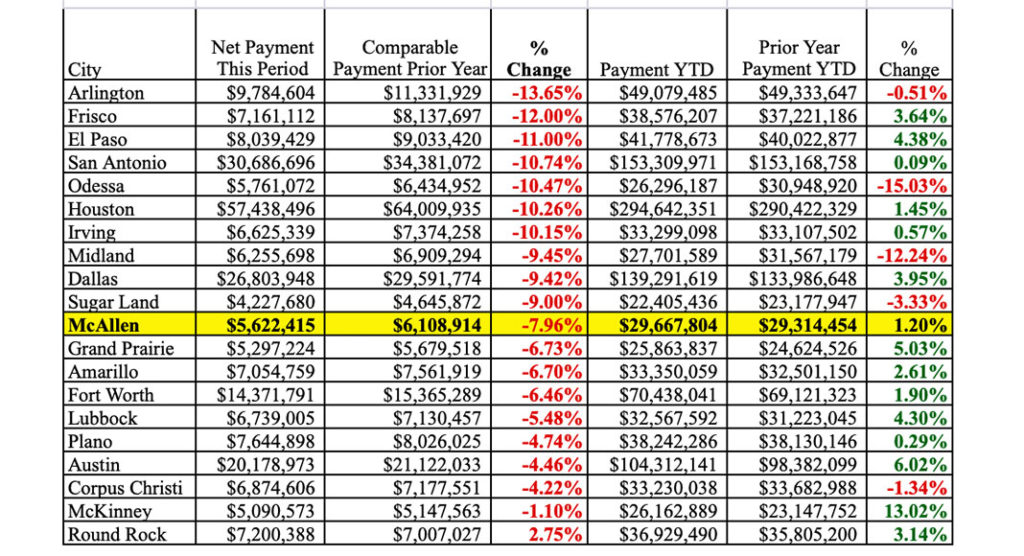

Texas Sales Tax Revenues Still On The Decline Reform Austin

News Roundup State House Democrats Declare Opposition To Sales Tax Increase Proposal Texas Standard

How To File And Pay Sales Tax In Texas Taxvalet

Cities With Highest Sales Tax Sales Tax Rates By City Tax Foundation

Texas Proposition 5 Sales Tax On Sporting Goods Dedicated To Parks Wildlife And Historical Agencies Amendment 2019 Ballotpedia

Texas Sales Tax Here S Why Republican Lawmakers Propose Raising Taxes Csmonitor Com